Your climate strategy deserves more than a simple line item. Our seven project design principles do not just add value, they multiply it for you.

With Carbon Credit Capital, you do not buy credits as an after the fact fix. You help build next generation nature based projects that sit inside your value chain as strategic assets, not external offsets.

These seven principles work together as one system. Each makes the others stronger and helps correct the failures you see in many conventional carbon markets.

If you want to turn credits into real advantage, Schedule a Consultation to learn more.

Every project delivers documented supply chain ROI as the primary investment justification. Your CFO can approve based on operational improvements; sustainability outcomes are developed to provide additional value.

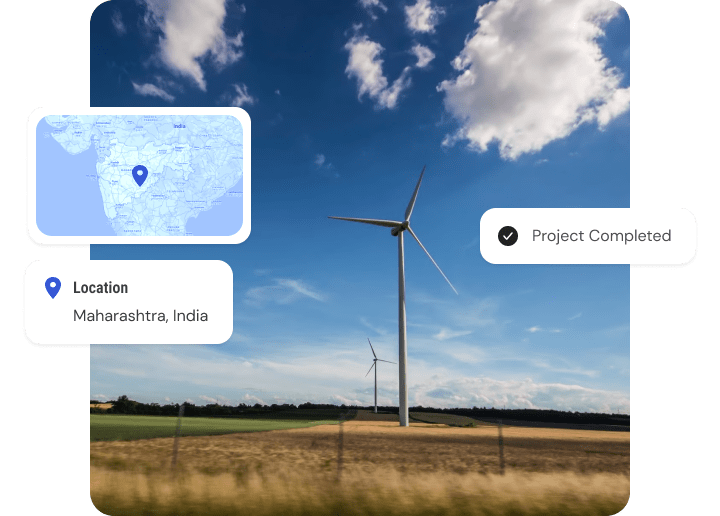

Projects embed within YOUR value chain, not at opportunistically selected sites chosen for credit generation potential. This means the projects address YOUR sourcing vulnerabilities and generate emissions reductions that qualify as insetting. This satisfies regulatory requirements that external offsets cannot meet.

Because projects occur within your Scope 3 boundaries, you can claim the reductions on your carbon inventory. Surplus credits become compensation that you can sell or use for marketing. Two distinct value streams from individual projects.

We design projects from inception to achieve Grade-A ratings from Sylvera, BeZero, MSCI, and Calyx Global. This isn't hoping for a favorable assessment… it is engineering projects to meet premium standards before implementation begins.

We combine biological sequestration with biochar and enhanced weathering to create storage on millennial timescales. Your carbon claims withstand scientific scrutiny and regulatory evolution for the coming decades rather than becoming stranded assets when permanence standards tighten.

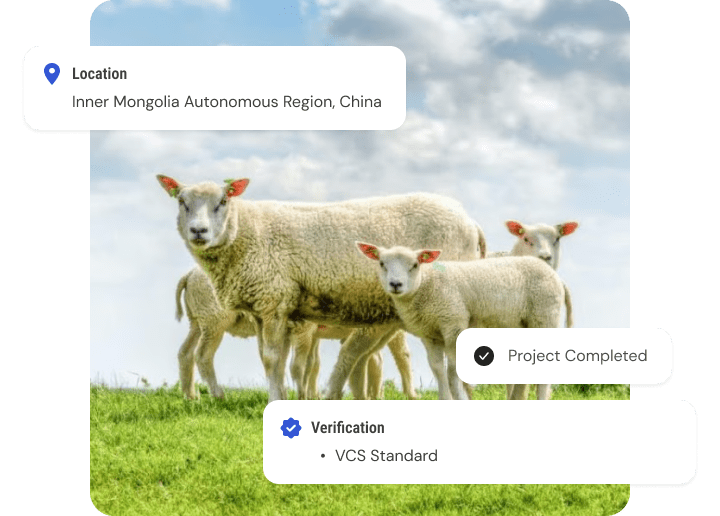

Communities hold equity stakes and governance authority… not just benefit payments. This creates aligned incentives for permanence that contractual mechanisms cannot match, while eliminating the social license conflicts that have destroyed both projects and corporate reputations.

20 to 30-year agreements provide stable financing independent of volatile spot markets. You get predictable carbon costs for financial planning. Locked in for 2030, all the way through to 2050. We get the patient capital needed for genuine quality investments.

Our projects are designed to reduce carbon emissions while supporting renewable energy, conservation, and circular resource use. Together, they contribute to credible and verifiable sustainability outcomes.

We guide you through every step of turning your idea into a certified carbon‑credit project—developing the methodology, preparing the Project Design Document, and submitting all paperwork to verification bodies such as Verra or Gold Standard. We also liaise directly with auditors, secure issuance of credits, and can help market your annual credit supply to buyers worldwide. Our 15+ years of experience ensures the process is cost‑effective and compliant from start to finish.

We make it easy for individuals and companies to fight climate change by supporting projects that reduce, avoid, or destroy greenhouse gases in the atmosphere.

We specialize in linking international and local partners to high-quality carbon emission reduction projects in developing and domestic markets through both traditional sales channels and innovative initiatives, programs, and partnerships.

We believe it should be possible for anyone, anywhere in the world to reduce carbon emissions, gain climate education, achieve emissions reduction targets and goals, and implement innovative solutions that guarantee effective climate action.

Olivia is an energy and environmental expert with 18 years experience in global environmental policy, finance, and carbon markets.

As President of Carbon Credit Capital, Olivia specializes in climate risks and provides guidance on corporate sustainability practices.